22 Feb , 2023

EQUIPPP: A case for the potential matchmaker in the Social Impact Ecosystem

Written By - Ayush Baheti, CFA, CMA, PGDRB (Co-Founder (FinRow Academy))

To Download the Report, Click here

Research Report

EQUIPPP: A case for the potential matchmaker in the Social Impact Ecosystem

Introduction

With the boom of the Internet, common facilitation and matchmaking platforms across various domains have turned into successful enterprises. Some of them are

1) Sulekha.com

2) Housing.com

3) Naukri.co

4) PolicyBazaar.com

Brief Overview

Sulekha.com

Sulekha is one of the earliest internet companies to come up in India It has evolved from a local business listing site to a technology-driven matchmaking platform from 2017 to now.

Sector: Local Services Valuation: ~ $250 million Funding: $44.6 million

Traction: 50,000 SMEs and 30 lakh businesses listed

Data Use case: Sulekha entered a strategic partnership with Axis Bank and provided the bank's SMB and SME customers special access to Sulekha's local services.

Housing.com

Housing.com is a real estate search portal that allows customers to search for housing based on geography, number of rooms, and various other filters.

Sector: Real Estate Valuation: NA Funding: $148 million

Traction: 6000 Brokers, 650,000 houses, 40 Cities

Data Use case: The data generated on Housing.com was used to create price heat maps and these maps help people gauge price variations across the city.

Naukri.com

Naukri.com is a recruitment platform that provides hiring-related services to corporates/recruiters, placement agencies, and job seekers in India and overseas.

Sector: Recruitment Valuation: $ 3.5 Billion Funding: $ 50 Million

Traction: 46 million registered job seekers and 61,000 unique corporate customers

Data Use case: Employment reports generated by the Naukri website provide various hindsight like skills that are in demand, hiring across sectors, etc.

Policy Bazaar

Policy Bazaar is India’s largest aggregator and marketplace of all insurance products. Policy Bazaar helps customers in researching and comparing various insurance policies, helping them in making an informed decision.

Sector: Insurance Valuation: $3 Billion Funding: $800 Million

Traction: 100 million visitors each year and Sells 15000 policies per month

Data Use Case: LIC tied up with policy bazaar to amplify its insurance reach.

The above-mentioned platforms have acted as matchmakers and built a huge ecosystem propelled by the insights and analytics of data generated in the platforms.

EQUIPPP: The Potential Matchmaker of the Social Impact Ecosystem

With this as background, I have been observing the EQUIPPP script for the past few days and with my interest in micro-cap companies, I have dwelled deep into this company.

EQUIPPP appears to have just come out of insolvency. A tiny streak of revenue started recently. However, broadly three things grabbed my attention.

Firstly, the mentioned platforms and service offerings with a special focus on technology.

Secondly, the team which contains a board of directors with a diverse background like a large corporate entity, experienced CC-level members and a young forefront team with wide interests and expertise

Thirdly, generally, these internet-based companies like the above-mentioned start their journey as Startups, raising initial capital from Angel investors and subsequently in various series A,B,C etc. rounds. They finally unlock the value for investors in IPO.

However, EQUIPPP is already listed (IPO done) with Rs 10cr of EQUITY capital and 97% promoter holding.

Since it is already listed, it doesn't have to hustle with VC funding, IPO proceedings, etc. and It can widely focus on scaling up with a minimal capital infusion

According to their website, EQUIPPP is a “marketplace” of different types of social value projects across geographies and sectors, where different individuals and entities can showcase and participate.

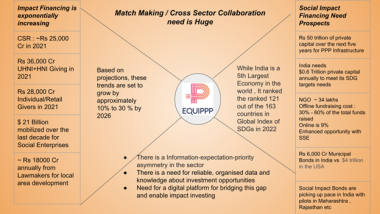

The numbers in the Social Impact ecosystem are mind-boggling. However, there is a clear need to match impact investors with potential social impact ventures and there appears to be no matchmaking platform for the same.

If EQUIPPP can successfully enlist the mentioned players in the social impact ecosystem like individuals, family houses, HNIs, Diaspora, CSR agencies, and funds along with curated social impact avenues like Government Agencies, SIBs, NGOs, Social Enterprises, etc., Their mentioned products and platforms could act as potential matchmakers.

Hence EQUIPPP has the potential to be the Sulekha.com of impact investing ecosystem. It will also have a strong first-mover advantage in the social impact sector.

This potential match-making and collaboration can generate invaluable data and insights and turn EQUIPPP into a very valuable data-centric enterprise. This could position EQUIPPP in a way more valuable orbit rather than the current IT consulting sector.

Data generated from the EQUIPPP platform can be leveraged in multiple ways.

1) Decision-making for large developmental financial institutions like the world bank, ADB etc.

2) Policymaking for governments

3) Data-driven solutions to large CSR foundations

4) CNSR Score along the lines of Credit Score for Individuals

Strengths

There appears to be a diverse and accomplished board of directors consisting of veteran bankers, academicians, development professionals, and serial entrepreneurs in place for EQUIPPP.

A C-level professional from BIG 4 and a young team from IITs and ISB seem to be working at the forefront of this company.

Recommendation:

According to a recent report by KPMG, the impact investing industry has reached an impressive valuation of $725 billion. This presents a significant market opportunity for organizations operating in this space. Through my analysis, I expect EQUIPPP has the potential to capture a fraction of this market share and it is clear that the organization is poised for success.

A potential investment to the tune of $2 million for this matchmaking opportunity can drive the company into a data-centric approach and can generate 8-10x returns for the investors in the span of 5 years.

EQUIPPP Social Impact Technologies Ltd

NSE: EQUIPPP Last Close: Rs 37.1/- (As on 21st February 2023)

Sector: Software and Consulting

RECOMMENDATION

Buy/Sell: Strong Buy Investment Horizon: Long Term (5 years)

Report by Ayush Baheti, CFA, CMA, PGDRB

Disclaimer - This report is made for educational purposes only. Investments in stock markets are subject to risks. Please take advice from your investment advisor before investing in any company or stock market.

References:

All the above data mentioned in this report is sourced from annual reports of mentioned companies, their websites, funding figures from CrunchBase, NSE and BSE websites and some publicly available articles etc.

Information from following articles:

https://bain.com/insights/india-philanthropy-report-2022/

Businesses get generous on CSR spends | Mint (livemint.com)

http://iiic.in/wp-content/uploads/IIC_2021_in_retrospect.pdf

Latest Blogs

-

Feb 22

EQUIPPP: A case for the potential matchmaker in the Social Impact Ecosystem

By Ayush Baheti, CFA, CMA, PGDRB

-

May 21

Top Internationally known Finance Certifications/ Qualifications that can boost your career in Accounting and Finance.

By Ayush Baheti, CFA, CMA, PGDRB